capital gains tax india

Web Capital gains tax in India Important rules to be aware of. Web Calculation of short term capital gains.

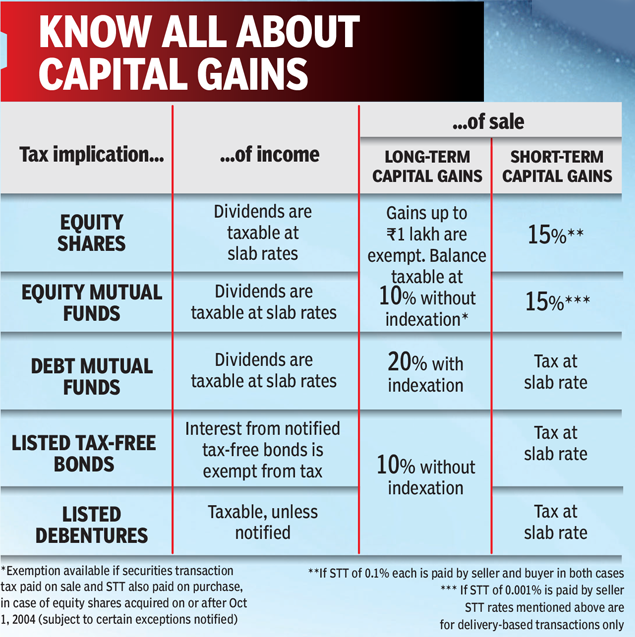

Union Budget 2020 Know All About Capital Gains Times Of India

Debt-based mutual fund schemes.

. Short Term Capital Gain Final. Web Tax on Long-Term Capital Gains. If your Income is comprised of Capital gains.

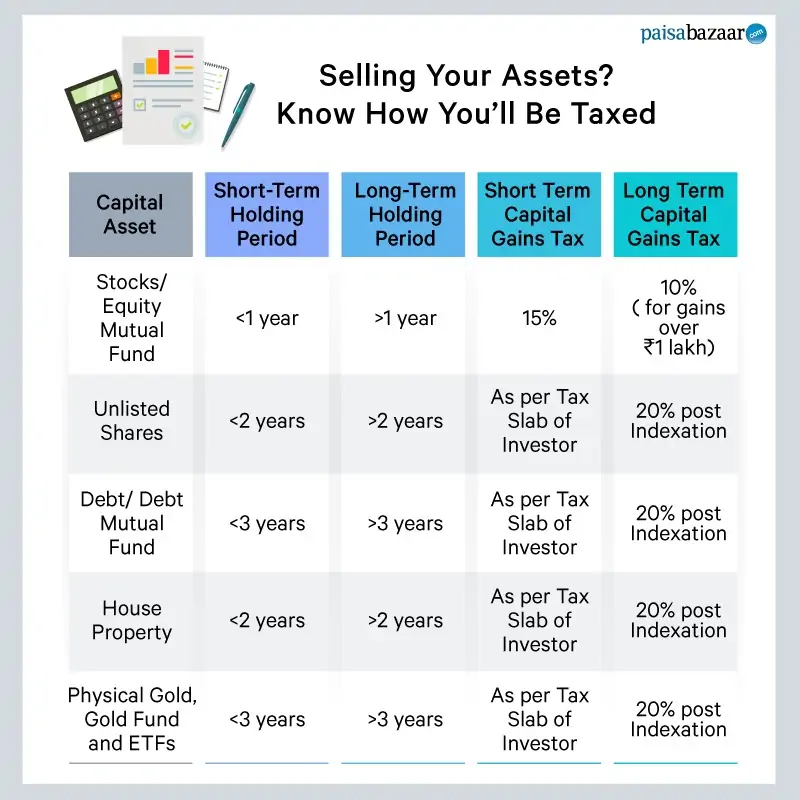

They will pay tax at 10. Taxpayers can claim the benefit of indexation. Web Just like STCG LTCG has also two different two different tax rate slabs for different asset categories.

Web Did your client sell any asset Mutual Funds shares property house land building etc between the period of April 1 2021 to March 31 2022. Currently the Short Term Capital. This gain comes under the category income and hence you will.

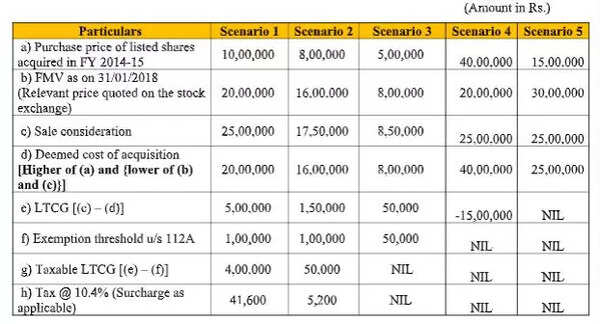

Web Currently long term capital gains are taxed at the rate of 20 plus health and education cess. Resident individuals who are below 60 years with an annual income of Rs. Web The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15.

Web More than 12 months. Up to 1 Lakh is non-taxable. Tax Breaks under section 80c to 80U is not available to Capital gain Income.

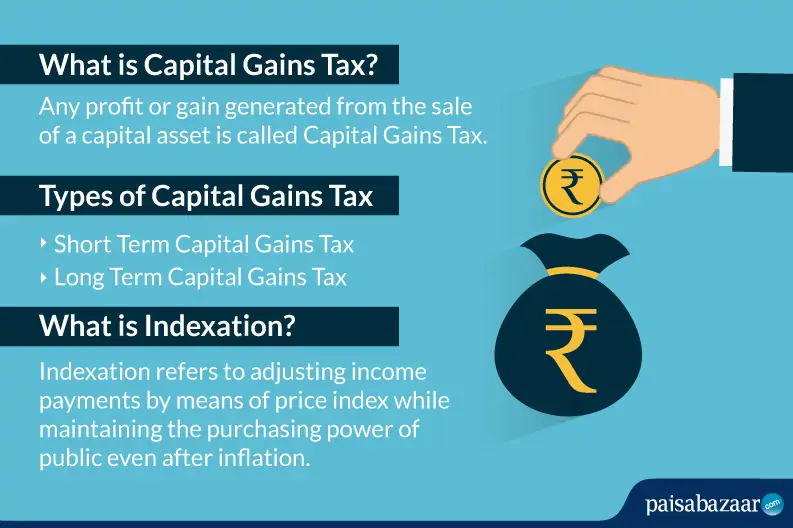

Web Formula for Calculation of Short Term Capital Gains. Tools To Nullify or. Capital gain can be understood as the net profit which an investor makes on.

Web But with the announcement of the new Budget 2022 it is capped at 15. Ad Browse Discover Thousands of Business Investing Book Titles for Less. In order to calculate short term capital gains the computation is as below.

Web TAX ON LONG-TERM CAPITAL GAINS Introduction. Tax Rate on Long-Term Capital Gains Tax Rate on LTCG Upon the sale of shares or units of equity. Web A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory.

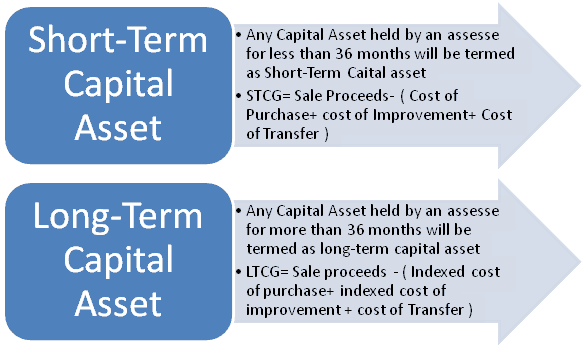

Any profit or gain that arises from the sale of a capital asset is a capital gain. Where securities transaction tax is applicable in case of equity shares and equity-oriented MF. More than 36 months.

In India the long-term capital gain on listed shares exceeding Rs 1 lakh comes under the purview of taxation. Web Some of the very important points that a seller of property must know with respect to capital gains tax are. If shares are sold through recognized stock exchange and Securities Transaction Tax STT.

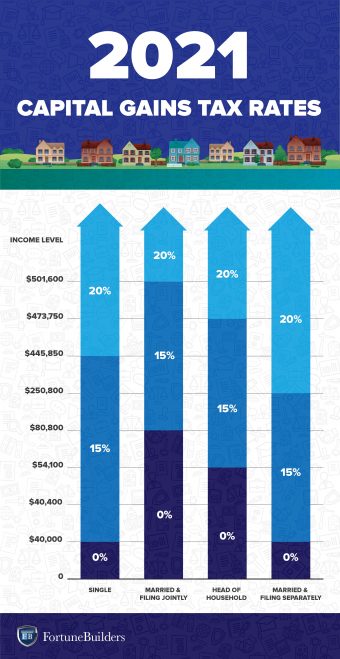

If securities transaction tax is applicable the long. Web Capital Gain Tax on Shares. In addition to federal capital gains tax rates.

Board of India Act 1992 will always be treated as capital asset hence such securities cannot be treated as stock-in-trade. To calculate the short term capital gain the formula is as follows. 10 tax on gains above 1 Lakh.

Web What is Capital Gains Tax in India. As per Indian tax law following surcharge is also. Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an.

Web The formula is calculated by subtracting the adjusted basis of an asset from its selling price at the time it was sold. Web From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. Web Here is a list of a few basic exemptions concerning long-term capital gains for the year 2021-2022.

Type of Capital Asset. If in above case Stamp Duty Value of property is INR 60 Lac then 60 Lac shall be considered as Sale Value and capital gains would be Rs 28 Lac. Along with capital gains we.

Web Section 112A. Full value of consideration cost of acquisition cost of improvement. Web Capital Gains Tax LTCG STCG Tax in India Definition Types Rates Exemptions.

Capital Gain How To Calculate Short Term And Long Term Capital Gains And Tax On These The Economic Times

What Are Some Facts About Taxation On Long Term Capital Gain Stock Market Or Mutual Funds In India In 2018 Quora

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Three Different Routes To Save Tax On Long Term Capital Gains Mint

The Overwhelming Case Against Capital Gains Taxation International Liberty

What Is Capital Gains Tax Definition Meaning Basics Of Capital Gains Tax

Exemption From Capital Gains On Debt Funds Paisabazaar Com

How To Disclose Capital Gains In Your Income Tax Return Mint

How Are Your Investments Taxed When Sold Paisabazaar

How To Save Capital Gains Tax On Property Sale

How To Save Capital Gain Tax On Sale Of Residential Property

What Are The Tax Implications Of Selling A 45 Year Old House In India By An Nri Quora

Union Budget Changing Face Of Capital Gains Taxation Since 2014 Times Of India

Rsu Taxes Explained 4 Tax Strategies For 2022

Understanding Long Term And Short Term Capital Gains

Mint On Twitter Govt Plans Reform In Capital Gains Tax India Is The Fastest Recovering Economy Says Chandrasekhar Cpi Inflation Stays Above Rbi Tolerance Level In February Read The Latest

Ltcg Tax On Equity Here S A Trick To Lower Your Tax On Capital Gains From Equity